Nobody looks forward to tax season. Unfortunately, for freelancers like artists, makers, and creators, figuring out how to do your taxes can be even more confusing than it is for people who aren’t self-employed. That’s because instead of having a single income to worry about, your income comes from all over the place.

On top of that, you’re responsible for identifying and keeping track of your own expenses and deductions, which can make a really big impact on how much you have to pay as income tax (or get paid back in a tax return) at the end of the year.

Tax forms are much less exciting than your creative work, but staying on top of your taxes throughout the year will give you the peace of mind—and a bigger tax return—to spend more time on what you love best, working on your art, finding freelance gigs, and building your portfolio. These tax tips will help you do just that!

Freelance Taxes: Do You Qualify?

Before your tax filing, you’ll want to make sure that you qualify to file as an artist or freelancer. Lots of people think you have to be registered as a sole proprietor or a business owner to file, but that’s not the case. You can (and should) start filing your freelance taxes as soon as you start generating income as an artist.

Have you sold a few paintings, or been hired to do some freelance graphic design work? If so, that income needs to be declared on your federal tax forms. Basically, as soon as you start operating as an art business or freelancer, you should file accordingly—even if your creative business is a side hustle.

So, What Can You Expense?

Great! You’ve determined that you qualify to file as an artist or freelancer in your country. The good news is that now you also qualify to expense, or deduct, certain costs that you’ve incurred throughout the tax year. The specifics of how to do taxes will vary a bit from one area to the next, but, in general, the same kind of things can be expensed or deducted on your tax forms.

Things you can deduct on your freelance taxes include:

Home office expenses: If your home is your primary office, you’ll be able to write off a percentage of costs like rent, heating, and electricity. Usually, this will be based on the percentage of your home that is used as an office, and the amount of hours weekly that you use it for that purpose. Any office equipment will also qualify. If you have a studio that you rent, that can be deducted from your taxes too.

- Art equipment and supplies: That’s right—those expensive lenses, pens, and drawing tablets are actually tools that are required for you to run your business, so you’ll be able to deduct some of those costs! Keep track of everything you use as a piece of equipment or tool in your business.

- Travel costs associated with your business: Even if you don’t have a car, if you’re frequently taking Ubers to get to client meetings, a good tax tip is to keep track of those because they are qualifying expenses.

- Fees or commissions associated with selling your work

- Any payments you made to subcontractors or employees

- Trade association memberships

- Fees for applying to art contests and competitions

- Accounting and legal costs

- Portfolio website design and development fees, as well as your monthly website fees. If you get a nice income tax return after claiming these expenses, you can put some of it back into your business. Want to upgrade your website, for example? You could go for a premium template! Bonus: these are purchases that can be expensed next year.

These are some of the most common things that artists and freelancers can deduct for a tax rebate, but it’s not an exhaustive list, so make sure to check how to do your taxes and what else qualifies in the area where you work.

Wondering how these deductions impact your income tax return? Basically, they don’t change your tax rate, but they reduce the amount of taxable income that the government will charge you income tax on. If you have $5,000 worth of qualifying expenses, or deductions, $5,000 will be deducted from your taxable income. It can add up!

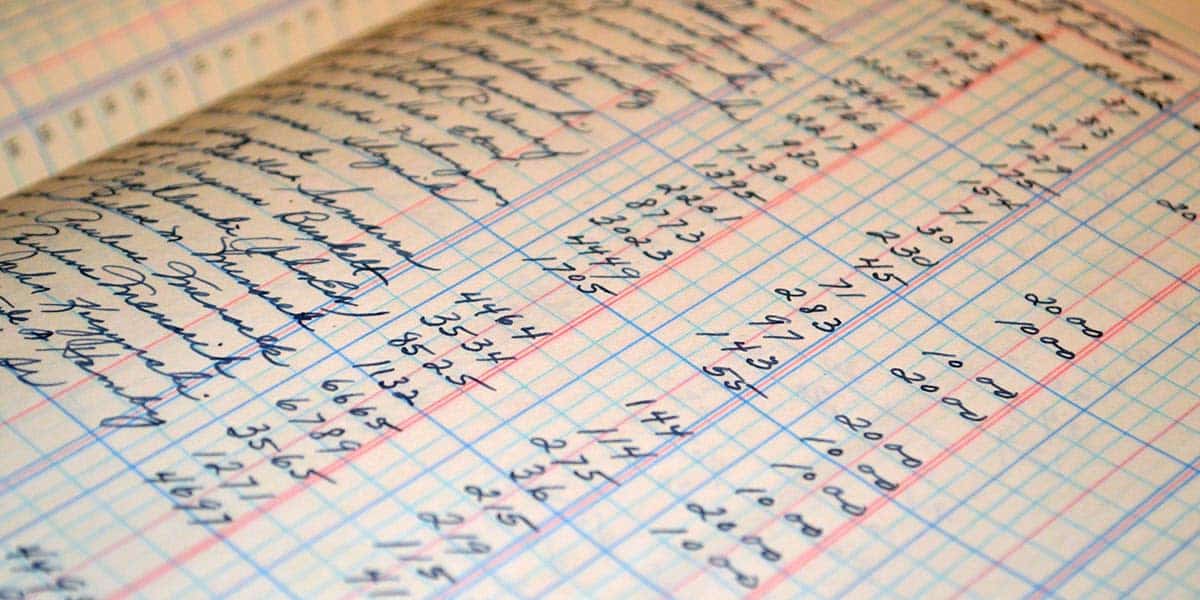

How To File Taxes As A Freelancer: Save Receipts

This list of qualifying expenses won’t do you any good when it comes to tax filing if you haven’t saved all your receipts! Our number-one tax tip if you want to learn how to file taxes is to make sure you keep every single qualifying receipt.

It’s better to err on the side of caution, and keep receipts for things that you’re not sure will qualify, just in case. That way, you can check with a professional later and see if you should toss it or not.

Designate two folders, one on your computer and one IRL, that these receipts should go into. Toss them in that folder as you get them and, especially in the case of paper receipts, make a quick note on the back specifying what it’s for if it isn’t obvious. Periodically, input those expenses into a free accounting software such as Wave, or whatever system works best for you.

A good way to stay on top of your freelance taxes—so you don’t get overwhelmed when tax time comes around—is to tie two admin activities together. You already update your online portfolio website once per quarter, right? Add in some time to your regular portfolio check-ups to also check in on any tax stuff you need to update to stay on track, such as filing those receipts.

If you start doing this, you’ll start to associate your tax check-ins with your regular portfolio refreshes, and it all becomes part of your regular administrative routine. Time management can be tricky for creatives, so little systems like this can help you make sure the important things, like freelance taxes, don’t get forgotten.

Don’t have a portfolio to update regularly? Setting one up is much easier than tax filing, and just as important for your creative business. Look for a website builder that has a built-in online store, so that you can put things like your art prints or crafts up for sale and generate some passive income while you’re busy creating new work and pursuing clients.

It’s also a good idea to choose an online portfolio that includes client proofing galleries. This is an awesome feature that your clients will love because it makes giving feedback super easy, but it’s also handy when you’re organizing your receipts to be able to refresh your memory by looking back at all the projects you worked on, and make sure you haven’t missed anything.

Tax Filing: Leave it to the Pros

There are some great, user-friendly e-filing platforms out there designed to make taxes easier to file, but when it comes to freelance taxes, you probably shouldn’t use them at first. Figuring out how to do taxes as an artist or freelancer is pretty complicated, and, while hiring an accountant to help will cost more than using an e-filing service, they’re also most likely to get you the biggest tax return possible. And remember: your tax accountant’s fee is a cost that you can expense next year!

You should do your homework and find an accountant in your area who specializes in freelance taxes and artist taxes. There are all sorts of special deductions and loopholes that an accountant will be aware of and know how to apply to your business, that as a creative business owner you just won’t be familiar with.

Reach out in your local arts community, and you’re sure to find someone who has had an awesome experience with a tax accountant they can recommend to you. Staying as organized as possible throughout the year, then handing the heavy lifting to a pro, is a tax tip make your tax season as painless as possible.

Reinvest That Tax Refund

While it’s probably tempting to treat yourself to something totally non-business-related with your federal tax return, it’s a good idea to re-invest some of that tax rebate into your business. We already talked about taking your online portfolio to the next level by upgrading to premium features, but you can also take stock of what new tools are out there that could improve your business.

Is there a lens that would make your wedding photography portfolio pop? Or a gimbal will transform your videos? Tax return season is a good time to upgrade your toolkit, so you can create gorgeous new projects to keep that portfolio fresh!

That wasn’t so scary, was it? We hope your next tax season is painless, so that you can focus on growing that creative business of yours!

Want more business tips for artists?

12 Creative Entrepreneurs Share Their Best Business Advice

Here’s How To Write An Amazing Instagram Bio In 10 Minutes

A Guide To Graphic Designer Salaries—And How To Negotiate Them